Financial management software is a tool that helps individuals and businesses track their income, expenses, and assets. It can be used to create budgets, track spending, and manage investments. There are many different financial management software programs available, each with its own strengths and weaknesses.

A lot of companies and high net-worth indivduals use these financial management tools because of the results they bring. The software help you plan your finances better, efficient, and even bring positive ROI from places you didn’t even thing.

Here is a list of the top 10 best financial management software programs for 2023:

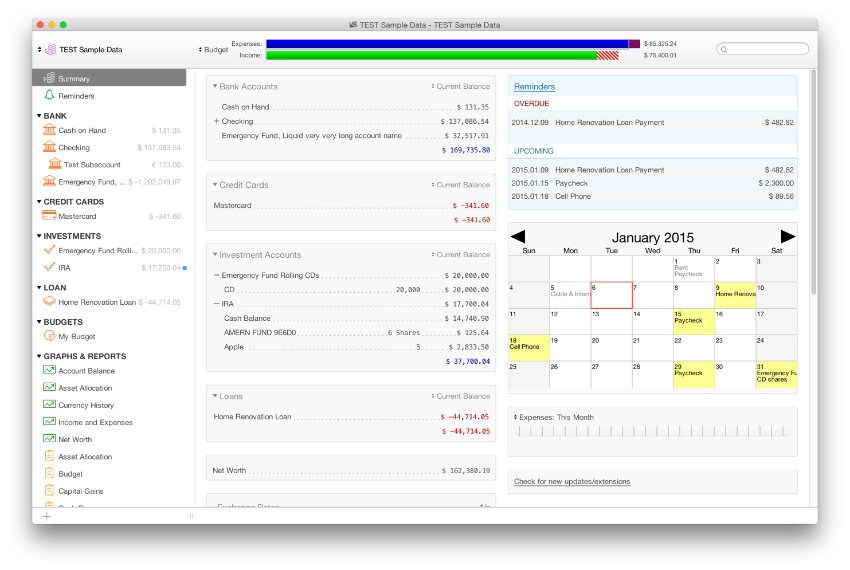

1. Quicken

Quicken is a popular financial management software program for personal use. It offers a wide range of features, including budgeting, bill paying, investment tracking, and credit card management. Quicken is easy to use and can be customized to meet the needs of individual users.

What makes Quicken such a great tool is that it is an all in one tool that nearly anyone can use to optimize their workflow and have a better result on their investments.

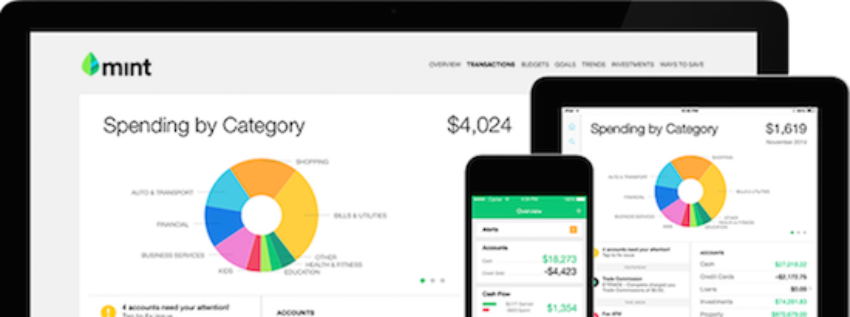

2. Mint

Mint is a free financial management software program that is offered by Intuit. Mint is easy to use and offers a variety of features, including budgeting, bill paying, and credit card management. Mint also provides access to credit scores and financial advice.

3. Personal Capital

Personal Capital is a financial management software program that is designed to help users achieve financial goals. Personal Capital offers a variety of features, including budgeting, investment tracking, and retirement planning. Personal Capital also provides access to financial advisors.

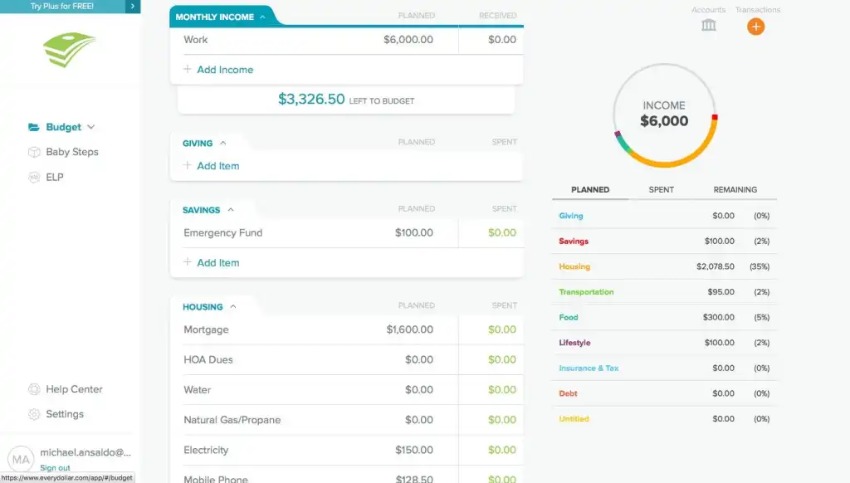

4. EveryDollar

EveryDollar is a budgeting software program that is designed to help users stick to their budget. EveryDollar is easy to use and offers a variety of features, including budgeting, bill paying, and goal tracking. EveryDollar is also free to use.

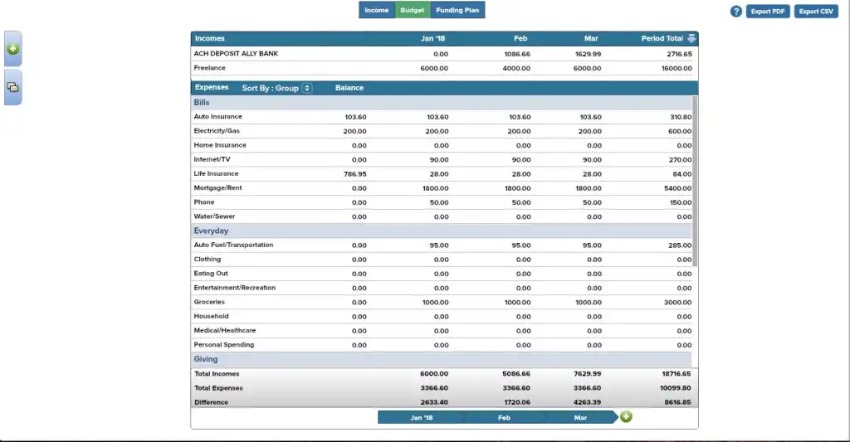

5. YNAB (You Need a Budget)

YNAB is a budgeting software program that is designed to help users get out of debt and save money. YNAB is easy to use and offers a variety of features, including budgeting, bill paying, and goal tracking. YNAB is also free to use for the first 34 days.

6. Moneydance

Moneydance is a personal finance software program that is designed for Mac users. Moneydance offers a variety of features, including budgeting, investment tracking, and bill paying. Moneydance is also free to use.

7. GoodBudget

GoodBudget is a zero-based budgeting software program that is designed to help users stay on track with their finances. GoodBudget is easy to use and offers a variety of features, including budgeting, bill paying, and goal tracking. GoodBudget is also free to use.

8. Mvelopes

Mvelopes is a budgeting software program that is designed to help users stay on track with their finances. Mvelopes is easy to use and offers a variety of features, including budgeting, bill paying, and goal tracking. Mvelopes is also free to use for the first 30 days.

9. MoneyLion

MoneyLion is a financial management app that is designed to help users build credit, save money, and invest. MoneyLion offers a variety of features, including budgeting, bill paying, and credit score monitoring. MoneyLion also provides access to loans and credit cards.

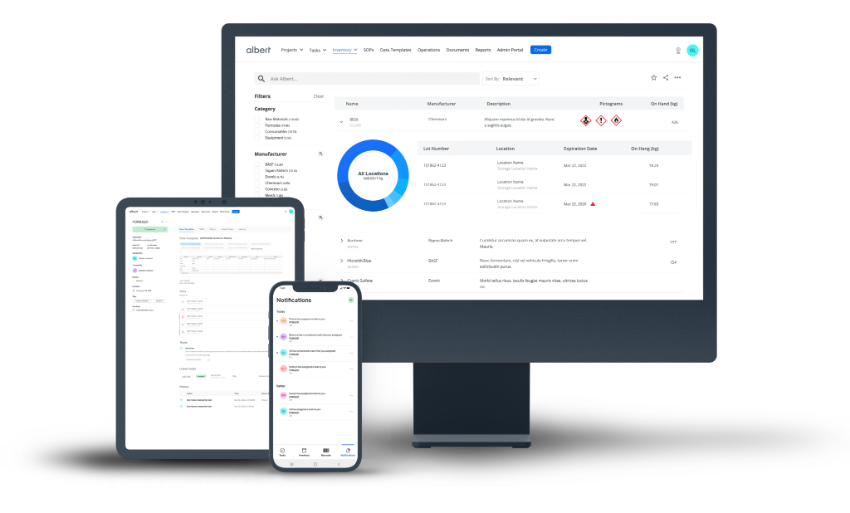

10. Albert

Albert is a financial management app that is designed to help users save money and invest. Albert offers a variety of features, including budgeting, bill paying, and investment advice. Albert also provides access to high-yield savings accounts and investment accounts.

These are just a few of the many financial management tools that are available. The best financial management tool for you will depend on your individual needs and preferences. It is important to compare different programs before making a decision.

Here are some factors to consider when choosing a financial management tool:

Features: The financial management tool you choose should have the features that you need to track your finances and achieve your financial goals. For example, if you are trying to get out of debt, you will need a tool that can help you track your spending and create a budget. If you are saving for a down payment on a house, you will need a tool that can help you track your investments and make sure you are on track to reach your goal.

Ease of use: The financial management tool should be easy to use and understand. You should be able to quickly learn how to use the tool and start tracking your finances.

Cost: Financial management tools can range in price from free to hundreds of dollars per year. Choose a tool that fits your budget.

Customer support: If you have any problems with the financial management tool, you should be able to get help from customer support. Choose a tool with good customer support.

With so many financial tools on the market, which one are you going to choose? These tools have different standpoints that you can choose to stay ahead of the game.