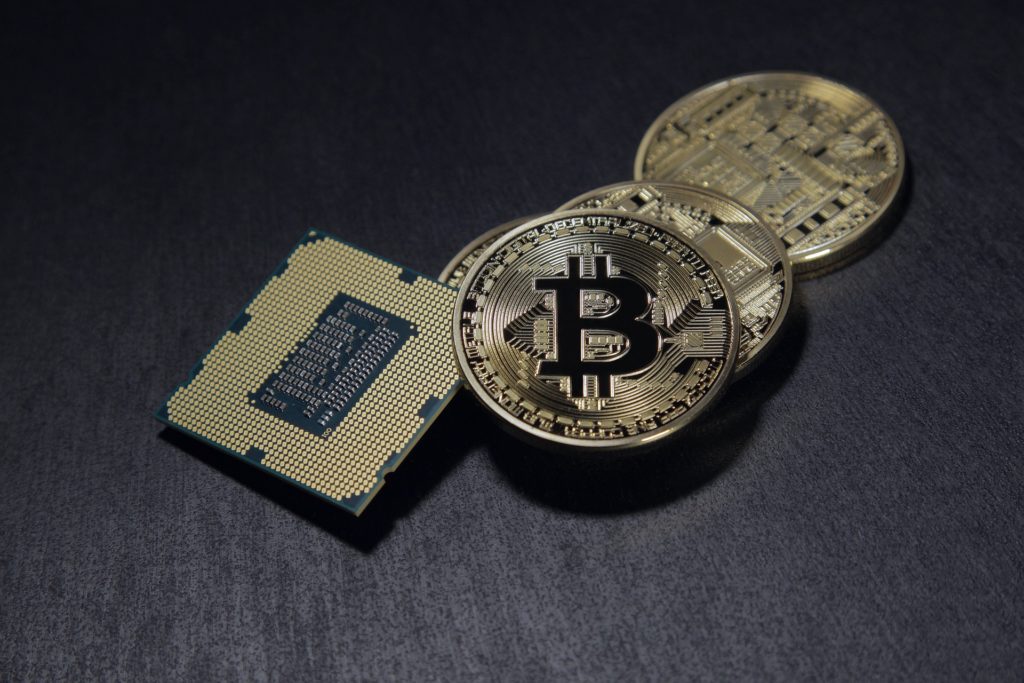

As the price of virtual assets plummeted, attention is focused on how much loss Tesla, an American electric vehicle maker that has recently sold out of bitcoin, has suffered.

The Wall Street Journal (WSJ) reported on the 25th (local time) that Tesla suffered a book-related impairment loss of about $170 million in bitcoin in the first half of this year in data submitted to the U.S. Securities and Exchange Commission (SEC). said to have appeared.

In US accounting, Bitcoin is considered an intangible asset.

When the price rises, the actual valuation gains increase, but the book value remains the same, and when the price falls, it must be recorded as an impairment loss.

In other words, when the price goes up, it is not reflected, and when the price goes down, it has an immediate effect on the income statement.

The WSJ said it was impossible to determine the exact size of the loss, as it is not known at what point Tesla bought and sold how many bitcoins.

According to data submitted to the authorities, some of the sold coins even made a profit of 64 million dollars.

However, it is predicted that a blow will be inevitable, as 75% of the bitcoins held during the recent plunge in virtual assets have been cleared.